Meezan Bank Easy Home 2026

Owning a home is a dream for many in Pakistan. To help make that vision real, the Administration of Pakistan together with State Bank launched the Mera Ghar Mera Ashiana (MGMA) scheme, contribution subsidized Islamic home finance. Meezan Bank contributes in this scheme via its product Easy Home – Mera Ghar Mera Ashiana. In this article, you will find full, up-to-date details: eligibility, process, leaflets, rates, benefits, and all you need to apply flawlessly. No need to search elsewhere.

Quick Summary Table for Meezan Bank Easy Home

| Program / Product | Start Date | End / Duration | Maximum Financing / Tier | Subsidized Rate / Profit Rate | Application Mode |

|---|---|---|---|---|---|

| Easy Home – Mera Ghar Mera Ashiana (Meezan Bank) | Ongoing (launched with MGMA) | Up to 20 years | Tier 1: ≤ PKR 2 million; Tier 2: > 2 million up to ~3.5 million | Tier 1: fixed 5% for first 10 years; Tier 2: fixed 8% for first 10 years. After that: variable (KIBOR + margin) | In-branch (Meezan Bank) via Easy Home application (online inquiry possible) |

Note: The above rates are for the subsidized period (first 10 years). Beyond that, the rate becomes variable per market benchmarks.

What Is “Mera Ghar Mera Ashiana / Easy Home”?

Mera Ghar Mera Ashiana (MGMA) is a cover finance subsidy and risk-sharing scheme presented by the Administration and State Bank to make home ownership affordable especially for first-time purchasers and low to middle income groups.

Meezan Bank offers this via its Islamic home money product Easy Home, below Shariah-compliant Lessening Musharakah mode. Under this style:

- The bank and customer jointly own the property initially.

- Customer pays rent for the bank’s share and gradually buys the bank’s share (units) over time.

- Eventually, the customer becomes full owner.

Meezan describes this as co-ownership, not a loan.

Eligibility Criteria (Who Can Apply)

To apply under this scheme via Meezan Bank Easy Home, you must satisfy:

Basic Requirements

- Pakistani citizen holding CNIC (resident)

- First-time homeowner: you must not already own a house/flat in your name

- Age limit: usually minimum 20 years, maximum 65 years (or retirement age) at maturity.

- Must show valid income / proof (for salaried or business)

- Property size limit: house up to 5 marla, or flat/apartment up to ~1,360 sq ft.

- Equity (down payment) from applicant: 10% of property value.

Meezan allows co-applicants (immediate family) and income of co-applicant may be clubbed.

Financing Amount, Tenure & Profit Rate

Amount & Tiers

- Tier 1: up to PKR 2 million financing

- Tier 2: above 2 million up to approx PKR 3.5 million

- There is no hard cap on property price (some limits per bank policy)

Tenure

- Maximum financing term: 20 years

- Borrower may choose tenure from 5 to 20 years (depending)

Profit / Markup Rate (Subsidized & Post-Subsidy)

- For first 10 years (subsidized period):

• Tier 1: fixed 5% p.a.

• Tier 2: fixed 8% p.a. - After 10 years, rate becomes variable: KIBOR + margin (e.g. +3%)

- The government also provides risk coverage / first-loss coverage (10%) for banks to reduce risk.

Also, Meezan’s base product pricing (non-subsidized) uses fixed + variable models with floors and caps.

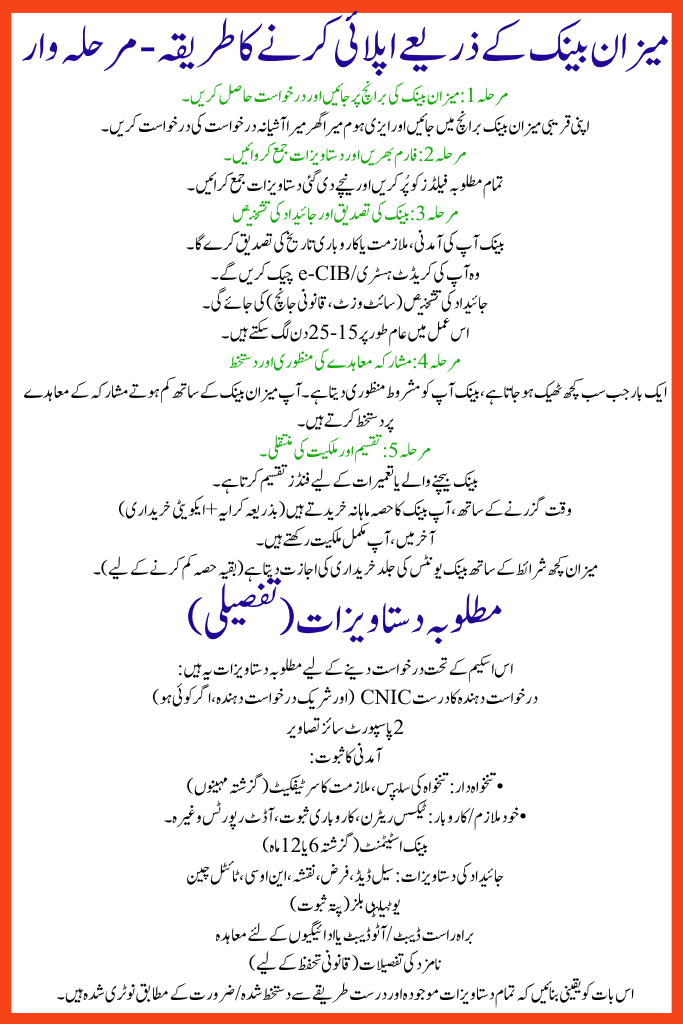

How to Apply via Meezan Bank – Step by Step

Step 1: Visit Meezan Bank Branch & Get Application

Go to your nearest Meezan Bank Easy Home branch and request the Easy Home – Mera Ghar Mera Ashiana application.

Step 2: Fill Form & Submit Documents

Fill in all required fields and submit the documents listed below.

Step 3: Bank Verification & Property Valuation

- Bank will verify your income, employment or business history

- They will check your credit history / e-CIB

- Property valuation (site visit, legal checks) will be done

- That process may take 15–25 days typically.

Step 4: Approval & Sign Musharakah Agreement

Once everything is in order, the bank gives you a conditional approval. You sign the Diminishing Musharakah agreement with Meezan Bank.

Step 5: Disbursement & Ownership Transfer

- The bank disburses funds to seller or for construction

- Over time, you purchase the bank’s share monthly (via rentals + equity purchase)

- In the end, you hold full ownership

Meezan allows early purchase of bank units (to reduce remaining share) subject to certain conditions.

Required Documents (Detailed)

Here are the required documents for applying under this Meezan Bank Easy Home scheme:

- Valid CNIC of applicant (and co-applicant, if any)

- 2 passport size photographs

- Proof of income:

• Salaried: salary slips, employment certificate (last months)

• Self-employed / business: tax returns, business proof, audit reports etc. - Bank statements (last 6 or 12 months)

- Property documents: sale deed, Fard, map, NOC, title chain

- Utility bills (address proof)

- Direct Debit / auto debit or agreement for payments

- Nominee details (for legal security)

Make sure all documents are current and correctly signed / notarized as needed.

Benefits of Applying via Meezan under MGMA

- Low subsidized profit rates (5% / 8%) for first 10 years, much lower than commercial rates.

- Long tenure (up to 20 years) reduces monthly burden.

- Islamic / Shariah-compliant financing (no interest, using Diminishing Musharakah).

- Only 10% down payment (equity) required, which is comparatively low.

- Risk buffer provided by government for banks (first loss coverage) helps banks support poor income applicants.

- Accessible across Meezan’s branch network (in many cities).

- Possibility of early unit purchase to reduce overall cost / share.

Common Mistakes to Avoid

- Submitting incomplete or outdated documents

- Using wrong or fake property titles

- Not verifying whether the scheme is currently active (status may change)

- Ignoring credit / e-CIB history

- Estimating eligibility without consulting bank

- Delaying payment or missing installments (adversely affects credit record)

Final Thoughts

If you dream of owning a home but face monetary restraints, Meezan Bank’s Easy Home under Mera Ghar Mera Ashiana is one of the best options in Pakistan nowadays. With low subsidized rates for the first 10 years, Shariah-compliant structure, long repayment terms, and comparatively shy down sum, this scheme is designed to help genuine first-time homebuyers.

Before applying, always confirm the scheme’s status (occasionally policies get efficient), check Meezan Bank’s latest terms, and visit a bank branch to get the official application. With good groundwork and leaflets, you can turn your “ghar ka sapna” into realism.

Related Posts