PM Youth Business and Agriculture Loan Scheme 2026

The PM Youth Business and Agriculture Loan Scheme 2026 is one of the most important government programs for young Pakistanis who want to start or expand a business or invest in agriculture. This scheme is specially designed to support youth, small entrepreneurs, freelancers, and farmers by providing low-interest and easy loans through government-approved banks. Under the vision of economic growth and job creation, this program helps people become self-reliant instead of depending only on jobs. In this complete guide, Abdullah Khan explains every detail of the scheme using official government sources and updated information so that after reading this article, you do not need to search anywhere else.

Quick Information Table

| Feature | Details |

|---|---|

| Program Name | PM Youth Business & Agriculture Loan Scheme 2026 |

| Start Date | Ongoing (2026 Phase) |

| End Date | Open throughout the year (subject to government policy) |

| Loan Amount | PKR 100,000 to PKR 7.5 Million |

| Interest Rate | 0% to low markup |

| Loan Tenure | Up to 8 years |

| Age Limit | 21 to 45 years |

| Target Audience | Youth, startups, SMEs, farmers |

| Application Method | Online |

| Official Website | Government-approved portal |

What Is PM Youth Business and Agriculture Loan Scheme 2026?

The PM Youth Business and Agriculture Loan Scheme 2026 is a government-backed financing program aimed at empowering Pakistan’s youth. It supports small businesses, startups, freelancers, and agriculture projects such as livestock, dairy farming, poultry, and crop production. The main goal of this scheme is to reduce unemployment, promote entrepreneurship, and strengthen Pakistan’s economy by supporting productive activities.

This scheme is managed in collaboration with major banks and is monitored by the government to ensure transparency and fair access.

Who Can Apply for This Loan Scheme?

The eligibility criteria are simple and clear so that deserving people can benefit.

- Age Requirement: Applicant must be between 21 and 45 years.

- Nationality: Only Pakistani citizens with a valid CNIC can apply.

- Business Type: New or existing businesses and agriculture projects are eligible.

- Credit History: A clean or manageable credit record is preferred.

- Gender Inclusion: Both men and women can apply. Women entrepreneurs are encouraged.

Loan Categories and Financing Limits

The scheme is divided into different tiers based on loan amount and business scale.

Tier 1:

Small loans for startups and micro-businesses with minimum documentation. These are often interest-free or very low markup.

Tier 2:

Medium-level loans for growing businesses and agriculture expansion projects.

Tier 3:

High-value loans up to PKR 7.5 million for established businesses with solid business plans.

Agriculture Category:

Special focus on livestock, dairy farming, poultry, fisheries, and crops, especially for rural areas.

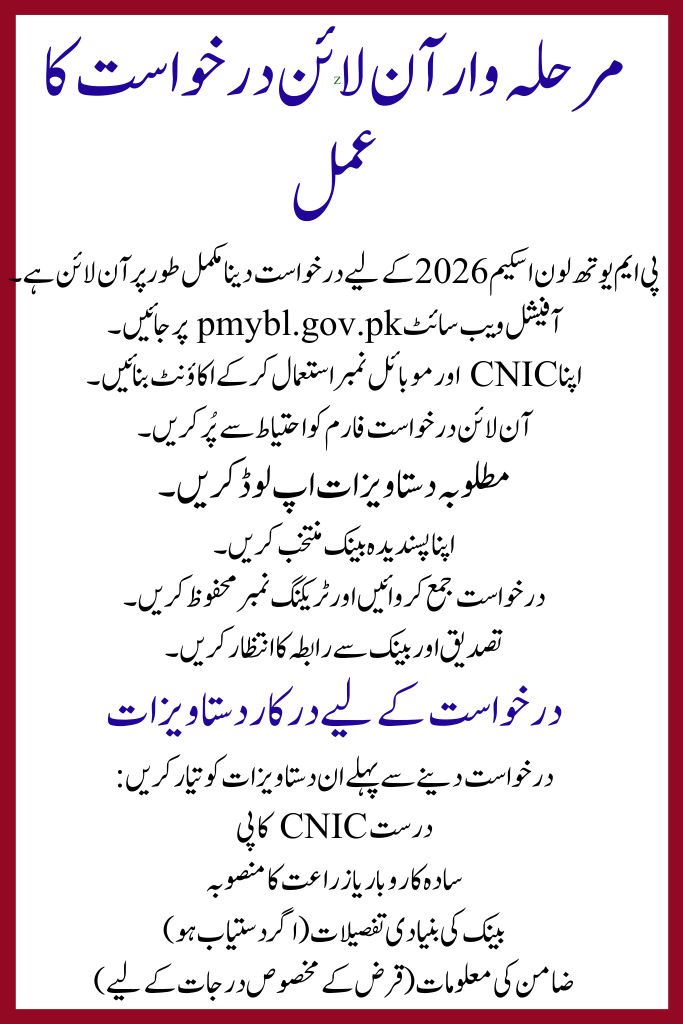

Step-by-Step Online Application Process

Applying for the PM Youth Loan Scheme 2026 is completely online.

- Visit the official website: pmybl.gov.pk

- Create an account using your CNIC and mobile number.

- Fill in the online application form carefully.

- Upload required documents.

- Choose your preferred bank.

- Submit the application and save the tracking number.

- Wait for verification and bank contact.

Required Documents for Application

Prepare these documents before applying:

- Valid CNIC copy

- Simple business or agriculture plan

- Basic bank details (if available)

- Guarantor information (for certain loan tiers)

Benefits of PM Youth Loan Scheme 2026

This scheme offers many advantages compared to private loans.

- Low or Zero Interest: Some loans are completely interest-free.

- Easy Repayment: Flexible repayment period up to 8 years.

- Youth Empowerment: Encourages self-employment and startups.

- Agriculture Support: Strong focus on rural and farming development.

- Transparent Process: Government-monitored system.

Helpline & Contact Information

For correct and updated information, always use official sources.

- Official Helpline: 0800-77000

- Email: info@pmybl.gov.pk

- Office Hours: Monday to Friday, 9 AM to 5 PM

Conclusion

The PM Youth Business and Agriculture Loan Scheme 2026 – Complete Guide proves that this program is a golden opportunity for young Pakistanis who want to build their future. With low-interest loans, easy online application, and government support, this scheme can turn small ideas into successful businesses. As Abdullah Khan advises, always apply through the official website and avoid agents or fake websites.

Frequently Asked Questions (FAQs)

Is the PM Youth Loan Scheme 2026 interest-free?

Yes, some loan tiers offer zero markup, while others have very low interest.

Can women apply for this scheme?

Yes, women entrepreneurs are fully eligible and encouraged.

How long does approval take?

Usually a few weeks, depending on verification and bank processing.

Is this information official and verified?

Yes, this article is based on government sources and updated online information.