Apply Now for Ramzan Business Loan Package of Up to 5 Crore

Ramzan is not only a month of blessings and ibadat, but also a very important season for businesses in Pakistan. During Ramzan, demand for food items, clothing, grocery, and services increases a lot. To help business owners manage extra expenses and grow their businesses, the government has introduced the Ramzan Business Loan Package of up to 5 Crore. This package is specially designed for small, medium, and growing businesses across Pakistan. Whether you are starting a new business or expanding an existing one, this loan can give you strong financial support during Ramzan 2026.

More Read: PSER Survey Online Registration for Ramzan Package

Quick Information Table for Apply Now for Ramzan Business Loan Package of Up to 5 Crore

| Feature | Details |

|---|---|

| Name of Program | Ramzan Business Loan Package 2026 |

| Start Date | January 2026 |

| End Date | Ongoing (Limited-Time Ramzan Offer) |

| Amount of Assistance | Up to Rs. 5 Crore |

| Method of Application | Online |

| Managing Authorities | Punjab Govt, Asaan Karobar, CDNS |

| Target Audience | Small & Medium Business Owners |

What Is the Ramzan Business Loan Package?

The Ramzan Business Loan Package is a government-backed financial initiative aimed at supporting Pakistani entrepreneurs during Ramzan. Under this package, eligible applicants can get low-interest or interest-free loans to manage cash flow, buy inventory, pay salaries, or expand their business operations. The loan limit can go up to 5 Crore, depending on the scheme and business type.

This package mainly works through different government schemes, including Asaan Karobar Loan Scheme, Maryam Nawaz Loan Scheme, and CM Punjab Loan Scheme 2026.

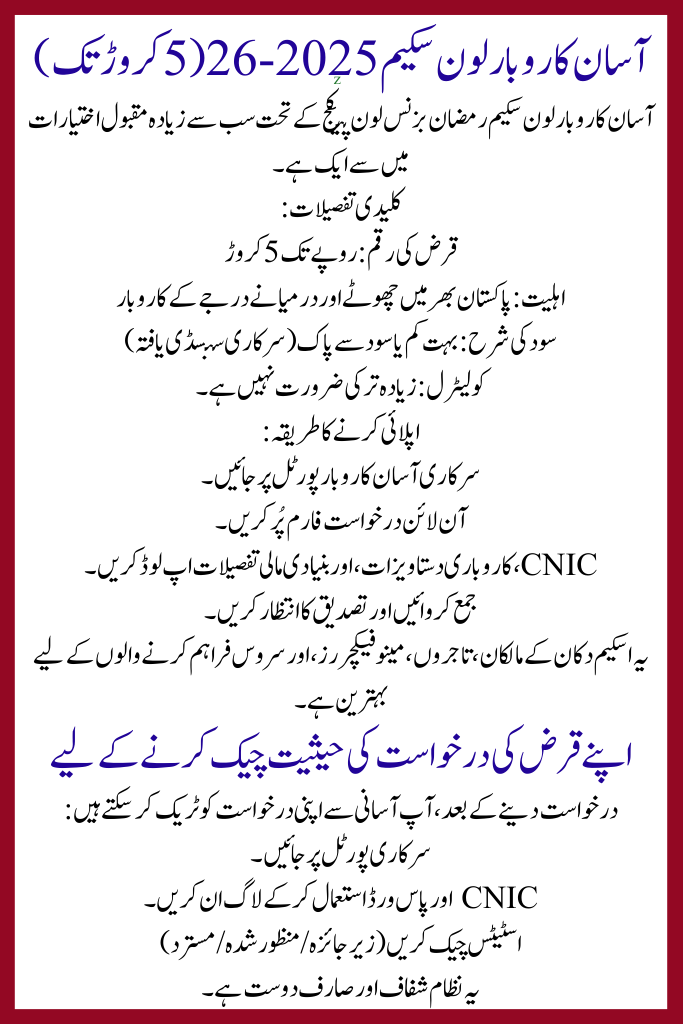

Asaan Karobar Loan Scheme 2025–26 (Up to 5 Crore)

The Asaan Karobar Loan Scheme is one of the most popular options under the Ramzan Business Loan Package.

Key Details:

- Loan Amount: Up to Rs. 5 Crore

- Eligibility: Small and medium businesses across Pakistan

- Interest Rate: Very low or interest-free (government-subsidized)

- Collateral: Mostly not required

How to Apply:

- Visit the official Asaan Karobar portal

- Fill the online application form

- Upload CNIC, business documents, and basic financial details

- Submit and wait for verification

This scheme is best for shop owners, traders, manufacturers, and service providers.

Maryam Nawaz Loan Scheme 2026 (For Women Entrepreneurs)

The Maryam Nawaz Loan Scheme is specially designed for women who want to start or expand their businesses.

Key Details:

- Loan Amount: Rs. 1.5 Lakh to Rs. 15 Lakh

- Eligibility: Female entrepreneurs in Pakistan

- Interest Rate: Very low

- Application: 100% online

Women running home-based businesses, boutiques, salons, or online stores can benefit a lot from this scheme.

CM Punjab Loan Scheme 2026

This Apply Now for Ramzan Business Loan Package of Up to 5 Crore scheme is for business owners who are based in Punjab province.

Key Details:

- Loan Amount: Depends on business size

- Eligibility: Punjab-based businesses

- Interest Rate: Highly competitive

- Focus: Small businesses and underserved areas

Cities like Lahore, Multan, Faisalabad, Rawalpindi, and Sialkot are fully covered.

Loan Scheme Comparison Table

| Loan Scheme | Loan Amount | Eligibility | Interest Rate | Apply Method |

|---|---|---|---|---|

| Asaan Karobar | Up to 5 Crore | Small & Medium Businesses | Low / Interest-Free | Online |

| Maryam Nawaz Loan | 1.5–15 Lakh | Women Entrepreneurs | Low | Online |

| CM Punjab Loan | Varies | Punjab Businesses | Competitive | Online |

How to Check Your Loan Application Status

After applying, you can easily track your application:

- Visit the official portal

- Login using CNIC and password

- Check status (Under Review / Approved / Rejected)

This system is transparent and user-friendly.

Tips for Successful Loan Approval

- Keep CNIC and business documents ready

- Apply for a realistic loan amount

- Clearly explain your business purpose

- Submit correct and complete information

- Regularly check application status

FAQs – Apply Now for Ramzan Business Loan Package of Up to 5 Crore

Who can apply for this loan?

Any eligible small or medium business owner in Pakistan.

Is collateral required?

Mostly no, especially under Asaan Karobar Scheme.

How long does approval take?

Usually 2–4 weeks, depending on verification.

Is this loan halal?

Most schemes are interest-free or government-subsidized.

Conclusion

The Ramzan Business Loan Package of up to 5 Crore is a golden opportunity for Pakistani entrepreneurs in 2026. With low-interest loans, easy online applications, and government support, these schemes can help businesses grow during the most important commercial season of the year. If you need financial support this Ramzan, don’t wait. Apply now and take your business to the next level.