Parwaz Card Loan for Overseas Students Complete Apply Guide 2026

Many Pakistani students dream of studying in top international universities in the UK, USA, Canada, Australia, or the Gulf. However, financial constraints often make this dream seem impossible. To solve this problem, the Government of Pakistan has introduced the Parwaz Card Loan for Overseas Students 2026. This government-backed program helps students cover tuition, visa, travel, and living expenses abroad, making overseas education more accessible and achievable.

Also Read ; BISP January 2026 Payment Dates

| Feature | Details |

|---|---|

| Program Name | Parwaz Card Loan for Overseas Students |

| Announced By | Government of Pakistan |

| Purpose | Financial aid for students studying abroad |

| Loan Type | Interest-free / low-interest educational loan |

| Eligibility | Pakistani citizens with confirmed foreign admission |

| Partner Banks | NBP, BOP, ABL, and others |

| Loan Amount Range | Up to PKR 2 million |

| Repayment | Starts one year after completion of studies |

What is the Parwaz Card Loan for Overseas Students?

The Parwaz Card Loan is a government initiative designed to support Pakistani students who have secured admission to foreign universities but lack funds. It provides a digital Parwaz Card, similar to a debit card, which can be used for:

- University admission and tuition fees

- Visa processing and flight tickets

- Initial accommodation and hostel charges

- Emergency or living expenses abroad

This loan is either interest-free or has very low interest, making it a safe financial option for middle-class and low-income families.

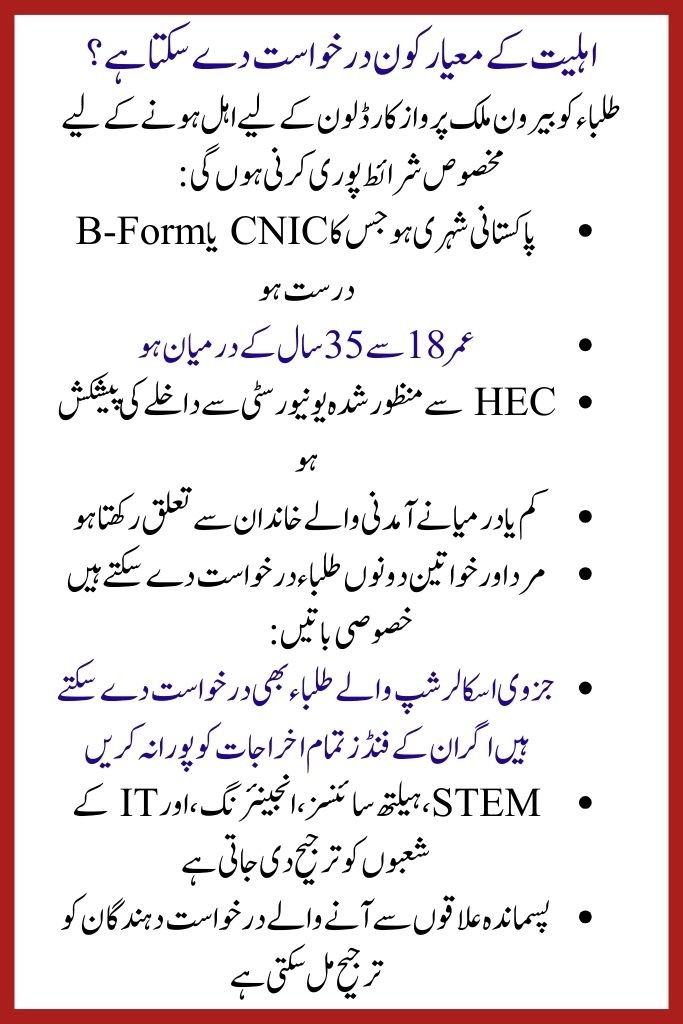

Eligibility Criteria Who Can Apply Parwaz Card Loan for Overseas Students Complete Apply Guide 2026

Students must meet specific conditions to qualify for the Parwaz Card Loan for Overseas:

- Pakistani citizen with valid CNIC or B-Form

- Age between 18 and 35 years

- Admission offer from an HEC-recognized university

- Belongs to a low or middle-income family

- Both male and female students can apply

Special Considerations:

- Students with partial scholarships can apply if funding does not cover all costs

- Priority is given to STEM, health sciences, engineering, and IT fields

- Applicants from underserved regions may get preference

Benefits of the Parwaz Card Loan for Students Parwaz Card Loan for Overseas Students Complete Apply Guide 2026

This loan program is designed to provide maximum support and ease to students:

- Interest-free or low-interest loans, especially for low-income families

- Easy repayment starting after graduation

- Direct payments to universities to prevent misuse

- Multiple uses including tuition, travel, visa, and accommodation

- Supports foreign currency payments to avoid exchange issues

- Nationwide access through partner banks and online portals

Documents Required for Application

Ensure all documents are ready before applying to avoid delays:

- CNIC or B-Form

- Passport (valid for at least 6 months)

- Admission/offer letter from an HEC-recognized university

- Educational certificates (Matric, Intermediate, Bachelor)

- Parent/guardian income certificate

- Bank statement (optional)

- Visa or I-20 document (if issued)

- Two recent passport-size photographs

Step-by-Step Application Process

Follow this simple procedure to apply for the Parwaz Card Loan 2026:

- Visit the official Parwaz Card Loan website or partner bank branch

- Download or collect the application form

- Fill in accurate details matching CNIC and university documents

- Attach attested copies of required documents

- Submit the form online or offline

- Application is verified by NADRA, HEC, and bank

- Receive approval and Parwaz Card issuance

- Loan funds are loaded onto your card or sent directly to the university

Partner Banks and Loan Disbursement

The Parwaz Card Loan collaborates with major banks for easy access:

- National Bank of Pakistan (NBP) — nationwide branches

- Bank of Punjab (BOP) — regional education centers

- Allied Bank Limited (ABL) — selected branches

- Habib Bank Limited (HBL) — joining soon

- Overseas Pakistanis Foundation (OPF) — supports visa verification

Loan Limits and Repayment:

- University tuition: Up to PKR 2,000,000

- Air ticket & visa: Up to PKR 500,000

- Hostel/accommodation: Up to PKR 300,000

- Miscellaneous/emergency: Up to PKR 200,000

- Repayment starts one year after graduation or employment

Helpline & Contact

For assistance, students can contact:

- National Bank of Pakistan: 021-111-627-627

- Bank of Punjab: 042-111-200-200

- Allied Bank Limited: 021-111-225-111

- Overseas Pakistanis Foundation: 051-921-2545

- Official Website: Parwaz Card Loan Official

Information confirmed from the official website

Conclusion

The Parwaz Card Loan for Overseas Students 2026 is a game-changer for Pakistani students aiming to study abroad. With interest-free loans, flexible repayment, and multi-purpose support, students can focus on education without financial worries. By following the official application steps and preparing documents in advance, every eligible student can access this opportunity and achieve their overseas education dreams.

FAQ

What is the maximum amount available under the Parwaz Card Loan?

The loan provides up to PKR 2 million for tuition and additional funds for travel and living expenses.

Can students with partial scholarships apply?

Yes, students can apply if their scholarships do not cover all education expenses.

When does repayment start for the Parwaz Card Loan?

Repayment starts one year after graduation or once the student secures employment, whichever comes first.

Which banks are currently participating in the Parwaz Card Loan scheme?

NBP, BOP, and ABL are currently active partners, with HBL expected to join soon.